How-Tos and FAQs

Your one-stop shop for tutorials, tips, and FAQs for making the most of your SELCO accounts.

Search resources

Search resources

Featured How-To Resources

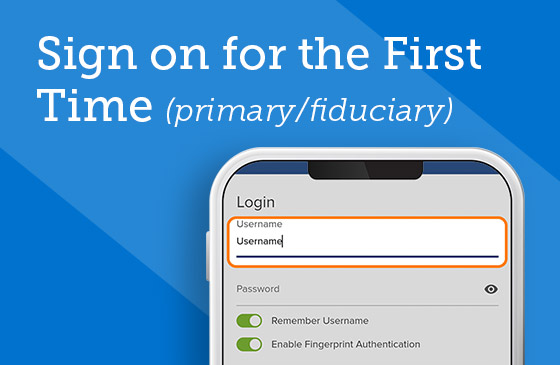

Sign on for the First Time

Easily make the transition from online/mobile banking to digital banking.

Register for Digital Banking

Sign up as an individual or business in a handful of easy steps.

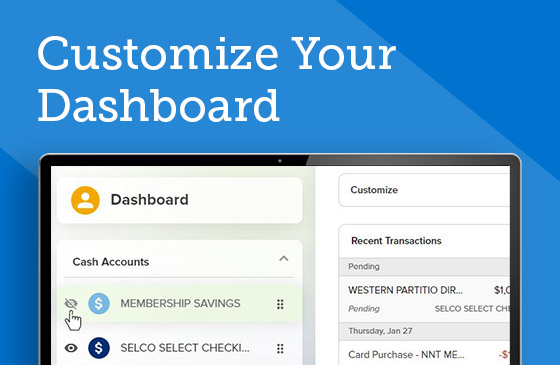

Customize Your Dashboard

Organize your digital banking dashboard however you’d like.

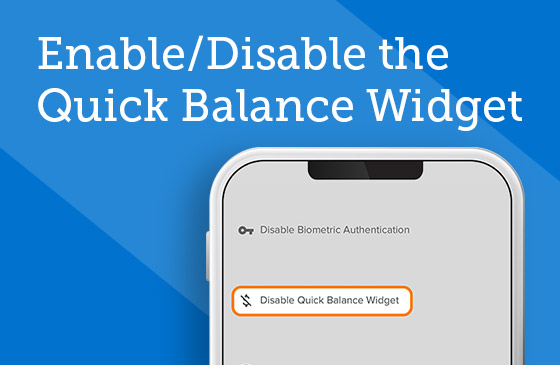

Enable/Disable the Quick Balance Widget

Quick Balance lets you see your account balances without logging in.

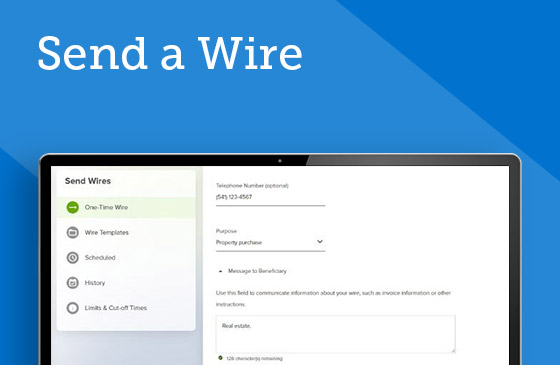

Send a Wire

What you’ll need to know to wire money within and outside the US.

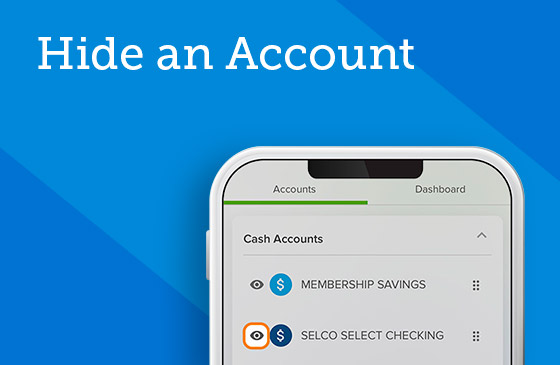

Hide an Account

Use the customize function to hide any of your accounts from viewing.

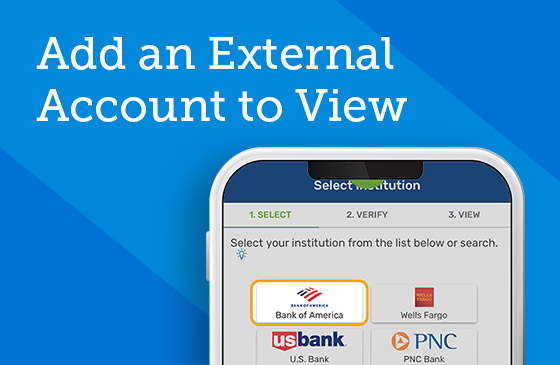

Add an External Account to View

Set up external institutions that you’d like to view from your digital banking homepage.

Check Your Credit Score

Get quick (and free) access to your credit score and report in digital banking.